city of montgomery al sales tax application

Combined Application for SalesUse Tax Form. All returns with aero tax payment should be filed with MyAlabamaTaxesalabamagov 2.

/cloudfront-us-east-1.images.arcpublishing.com/gray/VOGN2AILK5A2FIXKMDRE2ZUVNU.jpg)

2021 Tax Filing Tips From Aldor

Businesses that are located in the city of Montgomery or conduct business inside the city limits or police jurisdiction should contact the City Business License Department for city licensing information.

. On December 17 2007 the Montgomery County Commission voted to create a new administrative entity for Montgomery County. 2018 PJ Sales Tax updated Oct. Effective March 1 2008 the Tax and Audit Department will be the Montgomery County administrative entity for Sales Sellers Use Consumers Use Lodging Gasoline and Motor Fuel Taxes.

Montgomery AL 36103-5070 334 625-2036. Morris AL Sales Tax Rate. 2019 Sales Tax updated Oct.

Mooresville AL Sales Tax Rate. 2018 Wine Tax updated Oct. A Montgomery Alabama Sales Tax Permit can only be obtained through an authorized government agency.

In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions. City of Montgomery AL Inspections Department. Montgomery AL Sales Tax Rate.

Box 1111 Montgomery AL 36101-1111 4. Penalty - Late Payment. City of Montgomery 59 Monroe Street Montgomery AL 36104 334 241-2036.

All returns with zero tax payment should be filed with MyAlabamaTaxesalabamagov 2. Minimum of 50 or 10 of tax due Any correspondence should be mailed to. Penalty - Late Payment.

10 of tax due. In addition to the rental tax rates currently displayed on our website for the categories of automotive general and linen the City of Montgomery levies a tax rate that applies to the short term rental of a motor vehicle used primary for the transportation of 15 or fewer passengers for a period of sixty 60 or fewer consecutive. The County sales tax rate is.

Box 1111 Montgomery AL 36101-1111 For questions or assistance phone 334 625-2036 3. Go to city of birmingham web site wwwbirminghamalgov notice. 35283-0638 su-1099 city of birmingham revenue division room tl-100 city hall 710 n 20th st birmingham al 35203-2227 address service requested mail to.

Effective february 1 2021 the montgomery county wheel tax will increase to 7400. City of Montgomery is listed in the categories City County Government Government Offices City Village Borough Township and Government Offices Local. Penalty - Late Payment.

Payments can be made via the web. Interest For questions or assistance phone 334 625-2036 3. Montgomery County Commission Tax Audit Department P.

City of Montgomery - Frequently Called Numbers - Sales Tax Division is located at 25 Washington Ave in Montgomery AL - Montgomery County and is a local government specialized in Government. Montgomery City Hall 10101 Montgomery Rd. A certificate of occupancy will not be issued until the city has inspected the property for code compliance.

We recommend that you obtain a Business License Compliance Package BLCP. Min of 50 or 10 of tax due Any correspondence should be mailed to. Minimum of 50 or 10 of tax due Any correspondence should be mailed to.

Montgomery County AL Sales Tax Rate. It will contain every up-to-date form application schedule and document you need in the city of Montgomery the county of. Sellers use tax this package contains city of birmingham sellers use tax quarterly returns instructions to taxpayer.

Certificate of Occupancy Application - Pay Online A business may not occupy a building or tenant space or commence operations until the business owner possesses a certificate of occupancy. Box 4779 Montgomery AL 36103-4779 Tax Period and complete lower portion of back side TOTAL AMOUNT ENCLOSED Make check payable to. The State of Alabama administers over 200 different city and county sales taxes.

All returns with zero tax payment should be filed with MyAlabamaTaxesalabamagov 2. However we do not administer all county or city sales taxes. City of Montgomery Revenue Division PO.

This is the total of state county and city sales tax rates. Therefore be advised to contact all counties and municipalities in which you do business in. Moores Mill AL Sales Tax Rate.

2018 pj sales tax updated oct. The Alabama sales tax rate is currently. Combined Application for SalesUse Tax Form.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Penalty - Late Filing Fee. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail.

Date of initiated or proposed business activity. City of MontgomeryRevenue Division PO. 2018 PJ Lodging Tax updated Dec2018 City of Montgomery Lodging Tax updated Dec.

PJ Gas Tax updated Jan. 2018 Rental Tax Return- City Police Jurisdiction updated Oct. Box 1111 Montgomery AL 36101-1111 4.

Penalty - Late Filing Fee. The phone number to contact the. Montevallo AL Sales Tax Rate.

10 of tax due. In all likelihood the Application For SalesUse Tax Registration is not the only document you should review as you seek business license compliance in Montgomery AL. Morgan County AL Sales Tax Rate.

Montgomery OH 45242 513-891-2424. Alexander city auburn and montgomery al chevrolet shoppers can simply fill out our secure online credit application to get the ball rolling. Information on City Business Licenses.

RENTAL TAX TRANV. Fax 334 625-2994. Forms and Other Information.

Moody AL Sales Tax Rate. Penalty - Late Filing Fee. Montrose AL Sales Tax Rate.

Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO. Both landlords and tenants can create an account and. 2018 Whiskey Tax updated Dec.

Online filing available for sales tax reporting. In addition to the State Sales Tax local sales taxes are also due and these rates vary. SalesSellers UseConsumers Use Tax Form.

City of Montgomery Revenue Division PO. Motor FuelGasolineOther Fuel Tax Form. Interest For questions or assistance phone 334 625-2036 3.

The Montgomery sales tax rate is. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Montgomery Alabama Sales Tax Permit. Food Beverage Tax Form 7 PDF FILE Joint Petition for Refund PDF FILE Leasing Tax Form 3 PDF FILE Petition for Release of Penalty PDF FILE Sales Tax Form 12 PDF FILE Seller Use Tax Tax Form 13 PDF FILE Business License Application PDF FILE City of Mobile Alcoholic Beverage Application PDF FILE.

Sales Tax Audit Montgomery County Al

Maintenance Districts Montgomery County Al

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Alabama Sales Tax Guide For Businesses

Emergency Rental Assistance Montgomery County Eramco Montgomery County Al

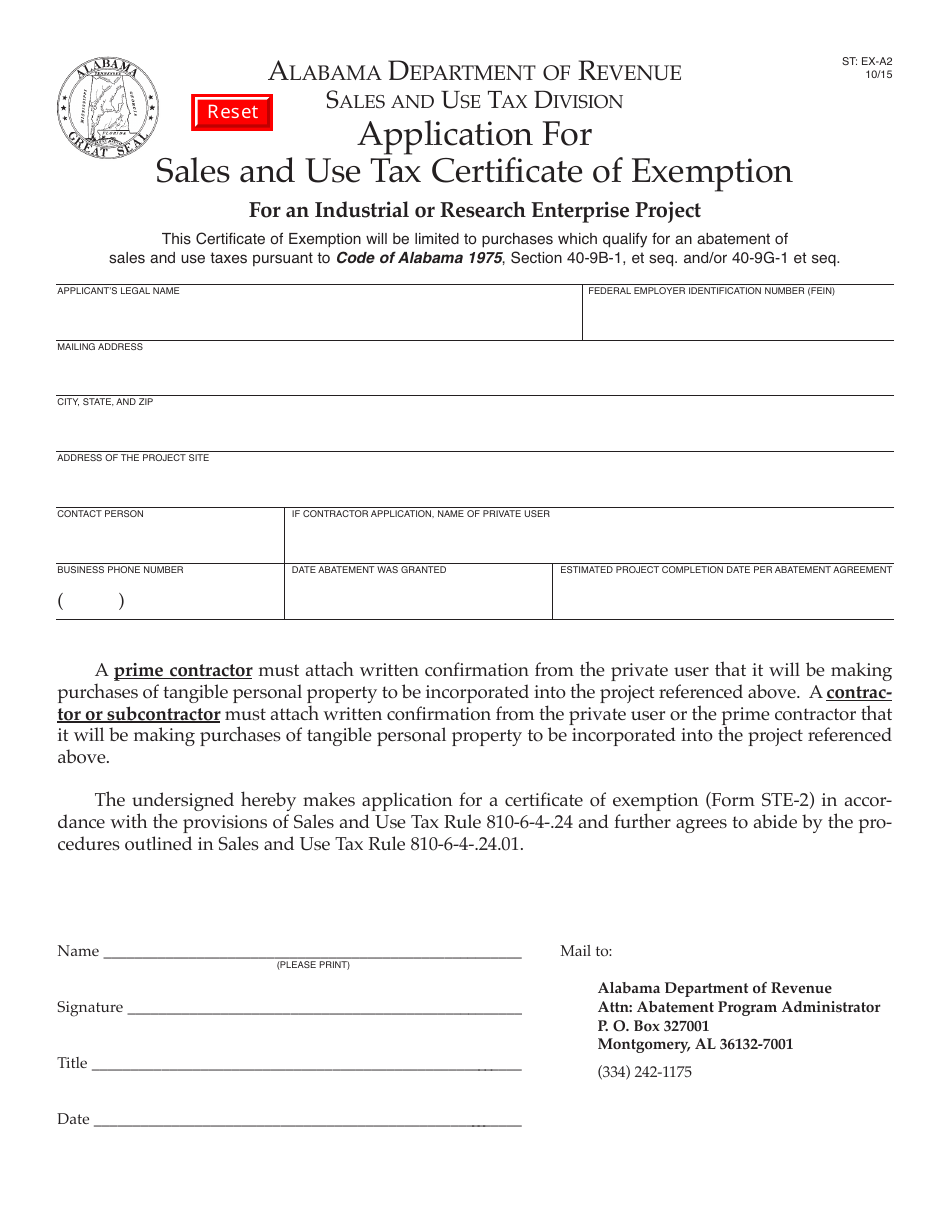

Form St Ex A2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

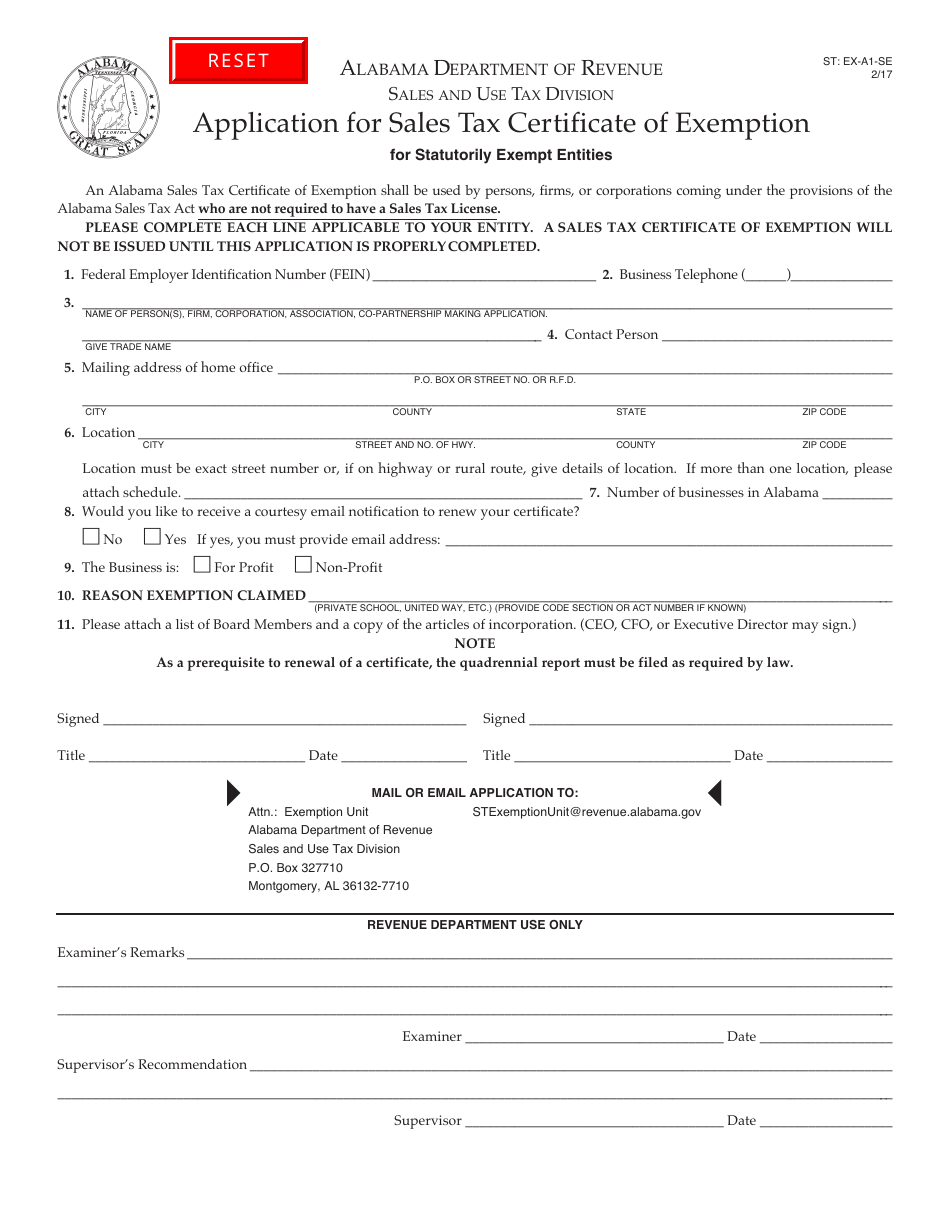

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

/https://s3.amazonaws.com/lmbucket0/media/business/atlanta-hwy-al-108-2PSH-1-3_G8fc1BJxK7F5IE90wviRQJ8nOCxxO-ejmyEpHttlw.10205012b026.jpg)

T Mobile Perry Hill Crossing Montgomery Al

Gis Mapping Tool City Of Montgomery Al

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer